Mapping the competitive landscape, physician adoption, and path to market

for Medical Device Startup (confidential client)

2021

A medical device company developing treatment for chronic lower back pain needed competitive intelligence and physician adoption analysis to inform their pivotal clinical trial design and potential acquisition discussions.

Working with a team at Penn Biotech Group, my task was to assess the competitive landscape and identify physician adoption barriers that would impact clinical trial design, commercialization strategy, and acquisition value.

Research Scope

- 10 physician interviews across 3 specialties

- 5 competing technologies evaluated

- 8-criteria competitive framework

- Multi-billion dollar market opportunity assessed

Key Deliverables

- Competitive landscape analysis

- Physician adoption drivers and barriers identified

- Target market redefined

- Clinical development strategy repositioned

- Pricing recommendation

My work

The client's technology targeted spinal disc degeneration — a market where conservative treatments and surgical options often fail.

Built competitive intelligence framework

- I evaluated 5 technologies across various modalities - hydrogel implants, cell therapies, molecular interventions, biologics

- I developed 8-criteria comparison matrix across clinical performance, operational scalability, commercial viability

| Criteria | Category | What it Measures |

|---|---|---|

| Invasiveness | Clinical | Procedural complexity and patient risk profile |

| Efficacy | Clinical | Pain reduction and functional improvement outcomes |

| Time to Effectiveness | Clinical | How quickly patients experience symptom relief |

| Stage of Degeneration Targeted | Clinical | Disease severity range where treatment is applicable |

| Recovery Time | Clinical | Post-procedure healing duration and activity restrictions |

| Ease of Scale-Up | Operational | Manufacturing complexity and distribution logistics |

| Cost | Commercial | Treatment price point relative to alternatives |

| Timeline to Approval | Commercial | Regulatory pathway and expected market entry timing |

Designed and executed primary physician research

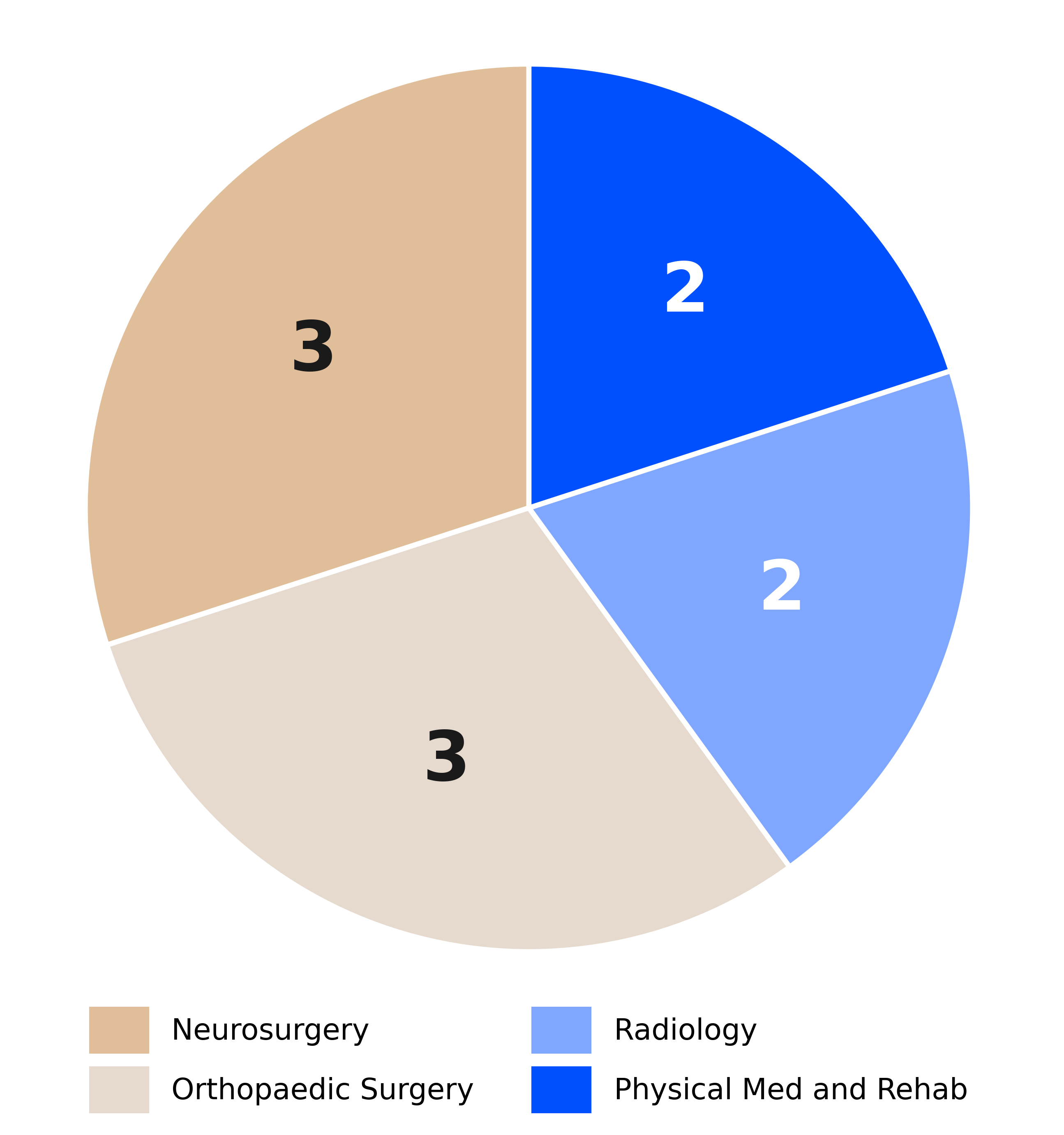

- 10 in-depth interviews: 6 spine surgeons, 2 radiologists, 2 physiatrists

- Segmented by specialty to capture the full adoption pathway:

- Physiatrists (gatekeepers): control patient referrals into the treatment gap

- Surgeons (primary adopters): make procedure decisions - decide between conservative treatments, minimally-invasive procedures, or full surgery

- Radiologists (technical executors): perform image-guided injections

- Geographic diversity: Northeast US, Canada, Texas

- Focused on uncovering real adoption drivers, rejection criteria, current treatment gaps. Not on validating existing assumptions.

What I found

- Competitive positioning revealed an unexpected vulnerability. The technology scored competitively on cost and scalability versus autologous cell therapies, but faced direct competition from other synthetic approaches that had already secured regulatory breakthrough designations.

- Safety objection > efficacy proof. Most surgeons expressed concern that the injection needle could damage the disc's outer ring and accelerate degeneration. This procedural risk concern overshadowed positive preliminary efficacy data.

- Long-term data was non-negotiable, not a "nice-to-have." Physicians required outcomes beyond 6 months in randomized trials with 100+ patients. Preliminary results weren't enough to overcome safety concerns.

- Different specialties had fundamentally different priorities:

- Surgeons focused on durability and revision surgery risk

- Radiologists wanted injection technique safety protocols

- Physiatrists were least receptive, preferring less invasive alternatives

Strategic impact

Repositioned clinical development

- Recommended a maximum needle gauge size for the injectable delivery based on physician interviews. Pivotal clinical trial was to reflect that.

- Pursue breakthrough designation.

- Added independent academic validation as critical path (not just company-sponsored data).

Redefined target market

- Shifted from "all degenerative disc patients" to moderate-to-severe treatment gap.

- Smaller TAM on paper, clearest value proposition in practice.

Segmented physician engagement

- Early adoption focus: surgeons + radiologists (procedural authority).

- Specialty-specific messaging

- Lead with long-term safety data

Bottom Line: Multi-billion dollar opportunity confirmed, but commercialization required safety-first evidence strategy and segmented market entry.