Unlocking new customer segments, defining positioning, and designing GTM campaigns

for Syneos Health

2024-2025

Early-stage biopharma companies typically face two paths to market: partner early and give up asset rights, or build full commercial capabilities at high capital and execution risk.

My team at Syneos Health offers the leading integrated commercial delivery model that enables customers to retain control of their assets and maintain strategic optionality for future exit. This is not a contract commercial services model but a strategic partner with skin in the game.

Customers are executive decision-makers at biotech companies, most often the C-suite. When I joined the team, segmentation, positioning, and tailored messaging were in their infancy.

Who has an undeniable need for this model?

The initial focus was on first launch companies. A key opportunity existed among biopharma companies expanding approved assets into new markets where they lacked local expertise. These de-risked assets were well suited for a global partner with regional experts.

- I defined criteria and metrics to design a target list of biotech companies that needed the "globalization" model.

- I equipped the sales team with tailored messaging and collateral to pursue these targets.

- I co-authored a white paper with the marketing team and subject matter experts, designed as a top-of-funnel demand generation asset showcasing expertise and regional nuances in drug launches across the US, EU, Japan, and China. The paper generated ~50% of the team's digital leads in 2025.

Who are the decision makers / influencers?

Biotech companies raise at every stage of clinical development. Their investors exert significant influence over decisions around asset licensing, sale, and strategic partnerships.

While designing an executive briefing in the Bay Area, I realized that the real gatekeeper to the attention of biotech C-suite was venture capital signaling. Biotech executives consistently follow the lead of investors they want or already have in their cap tables.

I anchored the event around VCs whose investment theses aligned with our target biotechs. First, their participation signaled trust through social capital and access to funding. This made recruitment of biotech executives dramatically easier. Second, many of these investors were board members at target biotech companies, so landing one VC often unlocked high-trust introductions to multiple targets.

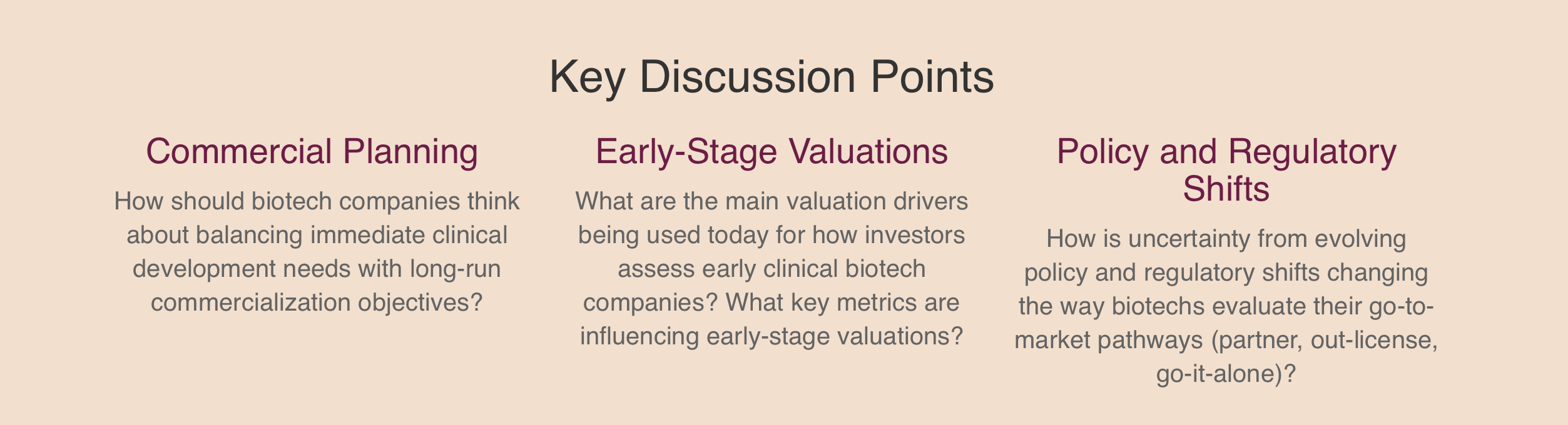

How can we build future pipeline, ahead of our competition?

Companies that were 3-5 years away from needing the integrated model needed to be engaged now. Why that early? I learned from the sales team that waiting until the moment of need was often too late.

Customers were left exposed to competitors or the deal became harder to justify to a board under time pressure. These were eight-figure deals with long sales cycles, and executives needed to develop curiosity and trust well before a decision point.

To support this, I co-authored a top-of-funnel demand asset focused on the growing importance of commercial readiness for clinical-stage biotechs, positioning the team's core offering early in the customer journey.