Translating scientific IP into a novel HIV monitoring platform

for The Wistar Institute Technology Transfer Office

2023

The challenge

This case study highlights how I translated complex clinical science into a clear product strategy, market entry roadmap, and investor-ready commercialization narrative.

The Wistar Institute's VP of Business Development & Licensing engaged our team to evaluate and position novel HIV-related intellectual property for commercialization. The underlying science focused on detecting latent viral reservoirs—a capability not addressed by existing diagnostic tools that measure only active viral load. The challenge was productization of this mechanism of action: to take proven research out of publications and into the hands of clinicians and patients.

We defined a phased product strategy with distinct target segments across the lifecycle, sequencing entry from clinical development customers to a future B2B2C model, with tailored value propositions and regulatory pathways at each stage. This four-month engagement culminated in an investor pitch delivered to a panel of four biotech investors.

The scientific breakthrough: detecting latent viral reservoirs

HIV exists in two states: active virus that is detectable in the bloodstream and suppressed by antiretroviral therapy (ART), and latent virus that remains hidden inside infected immune cells, undetectable by standard tests but capable of reactivating and causing viral rebound.

In 2020, scientists at The Wistar Institute leveraged principles of immunology to detect latent HIV infection through plasma-based biomarkers. Unlike nucleic acid tests (NATs), which detect active viral RNA, this platform:

- Used a disposable blood-based test

- Detected immune and metabolite biomarkers circulating in blood plasma, even when viral RNA was undetectable

- Established clinical correlation of biomarker patterns with viral persistence

- Developed proprietary machine learning models to generate:

- Probability of Viral Rebound (PVR)

- Time to Viral Rebound (TTVR)

Because latent HIV resides below the limit of detection of traditional NATs, measuring the immune system's biochemical footprint of infection provided a more sensitive proxy for viral reservoir activity.

Bridging discovery and commercial reality

Out of thousands of biomarker discoveries reported in literature each year, less than 1% translate into clinically useful and commercially viable diagnostics.

Our first question was: Who would pay for latent HIV prediction, and why?

The working hypothesis was a payer-reimbursed diagnostic, ordered through standard clinical channels. Early segmentation analysis revealed a critical constraint: clinical actionability.

Although the platform could estimate time-to-viral-rebound, this information did not change medical management under current treatment paradigms. ART suppresses active virus but does not eradicate latent infection. Physicians resumed ART only after measurable rebound. Without an actionable intervention, predictive data alone would not justify reimbursement or adoption in routine care.

There was, however, another market where prediction immediately changed decisions.

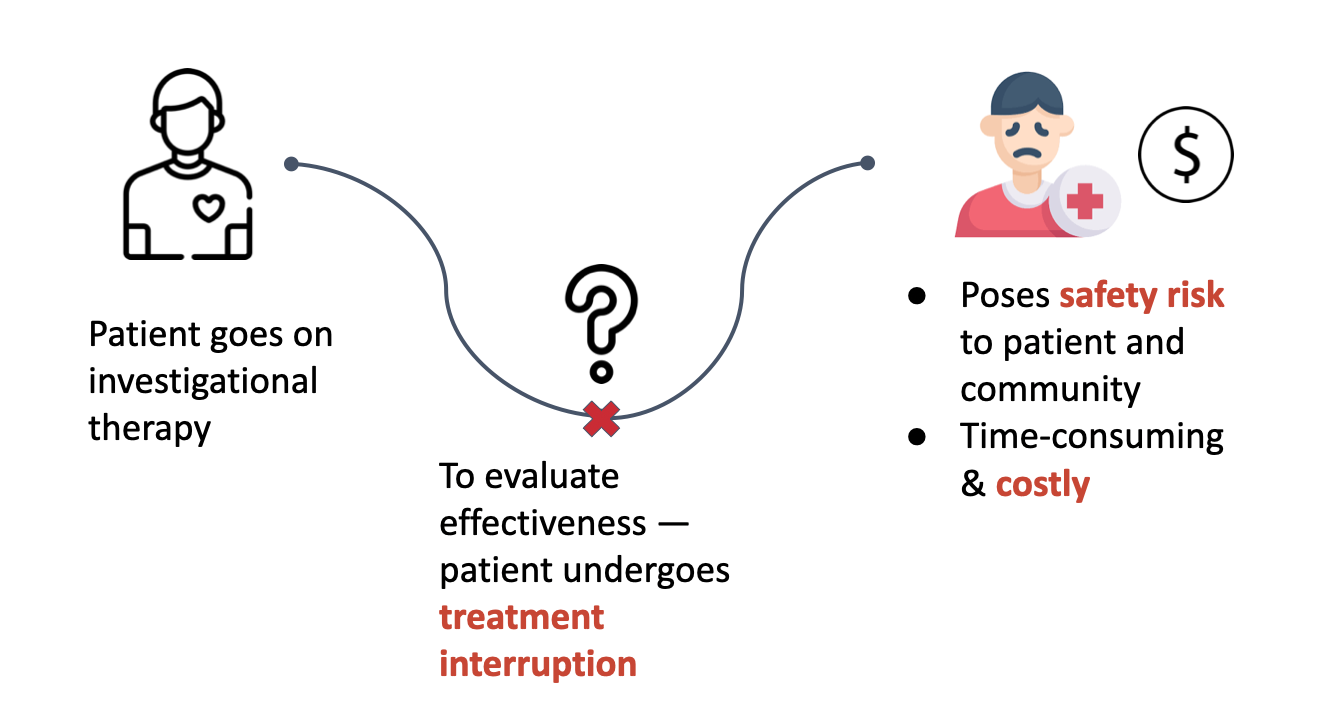

In clinical trials evaluating curative or remission therapies, patients must undergo analytical treatment interruptions (ATIs) to determine whether the virus rebounds after stopping therapy.

This created three major challenges:

- 12–24 week treatment interruptions

- Safety risk to patients and broader communities

- ~$50M total cost for a four-phase infectious disease trial

Instead of predicting recurrence, trials waited for viral rebound to occur.

Product strategy: defining the beachhead and lifecycle sequencing

We defined a staged commercialization strategy, with our initial beachhead being clinical development of HIV cures. In this segment, predictive rebound data directly influenced trial cost, risk, and timelines.

Phase 1: Clinical development decision support platform

Product: Laboratory-based immunoassay analyzer system with single-use reagent kits (GlySig)

Economic Buyer: Pharmaceutical clinical development teams (R&D budgets), NIH-funded trial networks

Decision Influencers: Translational medicine leads, biomarker strategy teams, and Principal Investigators designing interventional protocols

End User: Clinical research laboratory personnel running the assay; clinical trial teams interpreting predictive outputs

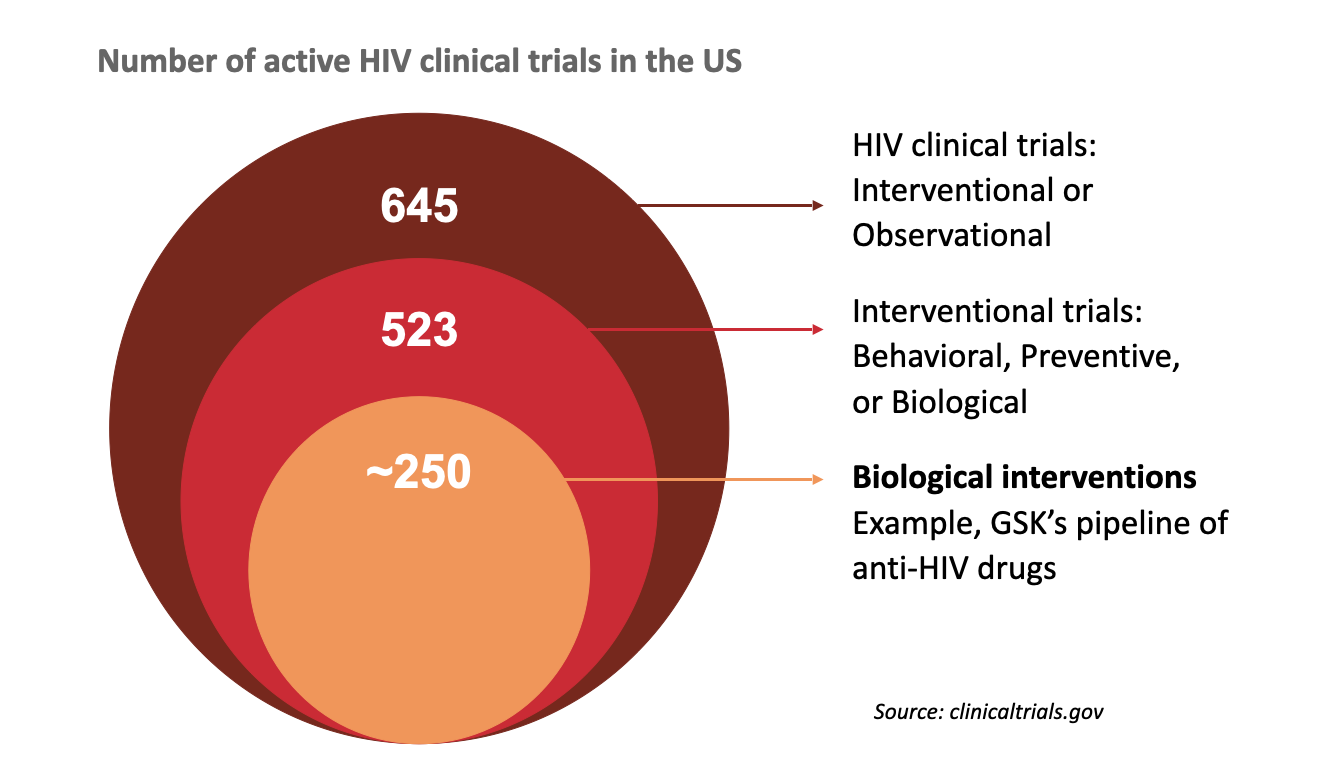

Market scope: 500+ active interventional HIV clinical trials in the US

Value Drivers:

- Trial acceleration

- Reduction in ATI duration

- Decreased patient risk exposure

- Improved go/no-go decision timing

- Capital efficiency in multi-phase infectious disease programs

GlySig tests 50,000 patients in clinical trials

Phase 2: Specialty care prognostic platform

Expansion to the B2B2C model was intentionally contingent on the emergence of remission or curative therapies that made rebound prediction clinically actionable in routine care. At the time of this work, multiple Phase I–III gene therapy, CAR-T, and broadly neutralizing antibody programs were underway, with significant NIH and pharma investment. With increasing scientific and regulatory focus on functional and sterilizing cures (non-ART approaches), we positioned the platform as infrastructure for future therapeutic shifts.

In early product visioning, we explored whether rebound prediction could resemble a rapid, home-based format similar to a pregnancy test. However, unlike pregnancy testing—which drives immediate binary behavior—rebound risk is probabilistic and clinically complex, requiring physician oversight and reimbursement alignment. This reinforced our decision to prioritize B2B2C over DTC.

Product: Portable point-of-care prognostic device integrating rebound probability analytics into specialty HIV workflows

Economic Buyer: Integrated health systems and specialty HIV treatment centers

Reimbursement Stakeholder: CMS and commercial payers determining coverage for relapse monitoring tests

Clinical Decision-Maker: Infectious disease physicians managing post-remission patients

End User: Physicians and specialty clinic staff conducting and interpreting rebound risk assessments, potentially patients long-term

Market Scope: ~1.2M people living with HIV in the U.S.; ~38M globally, contingent on remission therapy adoption

Value Drivers:

- Standardization of post-remission monitoring

- Relapse risk stratification

- Earlier clinical intervention

- Personalized follow-up cadence

Pricing and business model

Phase 1: R&D-funded clinical development

We structured the product under a capital equipment (analyzer) plus consumables (reagent kits) model, consistent with established immunoassay platforms.

Product Economics

Analyzer system: $50,000

Reagent kit: $30 per test

The $30 reagent price was originally benchmarked against per-test reimbursement norms in molecular diagnostics.

2025 Reflection:

With further experience since this work, I recognize this pricing was likely conservative. In the clinical development market, pricing should anchor to trial economics and not reimbursement parity. If predictive rebound analytics reduced ATI duration or accelerated go/no-go decisions in trials exceeding $50M, value-based pricing could justify materially higher per-test economics in the $300–$1,000 range.

Phase 2: Reimbursement-dependent specialty care

Unlike Phase 1, adoption here depended on reimbursement and health economic validation.

Regulatory roadmap

We sequenced regulatory strategy to align with commercialization risk.

Phase 1: Research-Use Deployment

Initial deployment was positioned within clinical trials under a Research Use Only (RUO) framework. This enabled:

- Prospective validation within controlled trial environments

- Evidence generation without immediate in vitro diagnostic (IVD) clearance

- Integration into central laboratory workflows

Positioning the product as a development-support tool rather than a patient management device materially reduced early regulatory burden.

Phase 2: IVD and Potential CDx Pathway (Conditional)

Expansion into routine clinical decision-making would require formal FDA clearance. Given the novelty of glycan-based predictive rebound analytics, a traditional 510(k) pathway may not be feasible if no predicate device exists. A De Novo classification—or potentially a PMA pathway if linked to therapeutic decision-making—would likely be required.

If rebound prediction becomes essential to the safe use of remission-focused therapies, the platform could evolve toward a companion diagnostic (CDx) model, necessitating co-development and regulatory alignment with therapeutic sponsors.

We intentionally staged commercialization to generate validation data in Phase 1 before assuming the higher evidentiary and regulatory thresholds required for clinical claims.

Investor narrative and exit strategy

We modeled staged capital raises aligned with inflection points: validation milestones, regulatory progression, and initial commercialization within the clinical development market.

Revenue projections were built bottom-up using:

- Active HIV clinical trial volume

- Assumed enrollment and test frequency

- Analyzer deployment rates and consumables utilization

We evaluated multiple exit pathways:

- Strategic acquisition by diagnostics platforms seeking predictive biomarker expansion

- Acquisition by pharma companies developing remission-focused therapies to embed rebound prediction into trial design or labeling as a companion diagnostic

- Platform expansion into additional viral persistence indications such as Hepatitis B and Hepatitis C, strengthening acquisition attractiveness

Key takeaways

- Scientific validity ≠ commercial viability. A biomarker can be statistically predictive yet commercially irrelevant if it does not change clinical decisions, reimbursement pathways, or capital allocation.

- Market entry must follow actionability, not TAM. The most intuitive segment (patients and hospital systems) lacked immediate economic justification.

- Unless reimbursement is involved, pricing in healthcare should anchor to net new value creation, not precedent.

This project fundamentally reshaped how I evaluate product-market fit in regulated healthcare markets.